capital gains tax proposal

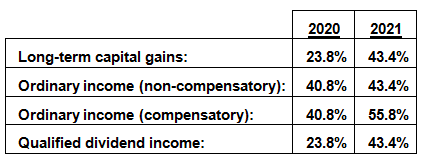

Currently all long-term capital gains are taxed at 20. Under the forthcoming proposal dubbed the American Families Plan the capital gains tax rate could increase to 396 from 20 for Americans earning more than 1 million.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

As it stands right now those in the high-income tax rate currently see only a 20 capital gains tax on certain assets.

. President Biden and his administration have long indicated there would be a change coming to the way capital gains. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax. He also proposed to repeal the Alternative Minimum.

If you decide to sell youd now have 14 in realized capital gains. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. The tax hike would apply to households making more than 1 million.

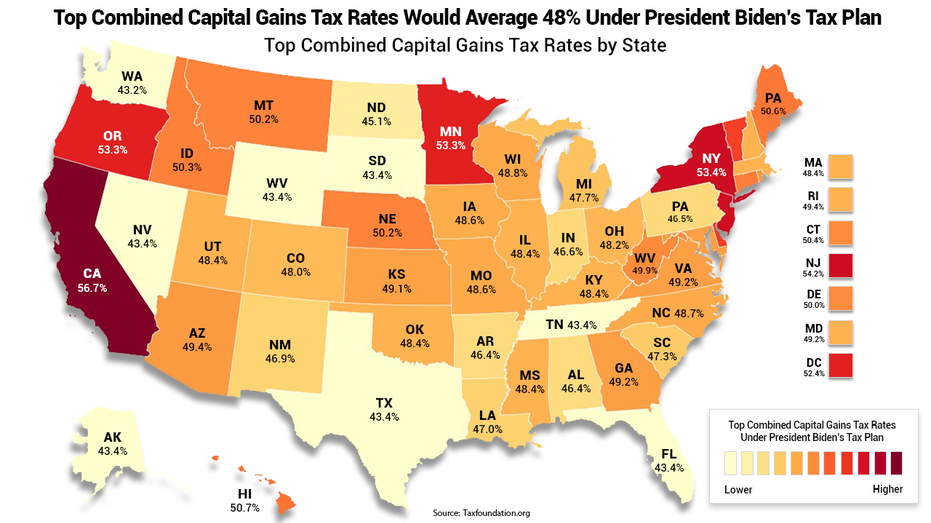

If you include state income taxes the. It hasnt been noticed much but proposed changes to capital-gains taxes have good news for some of the highest-earning Americans and bad news for those earning between. It would apply to those with more than 1 million in annual income.

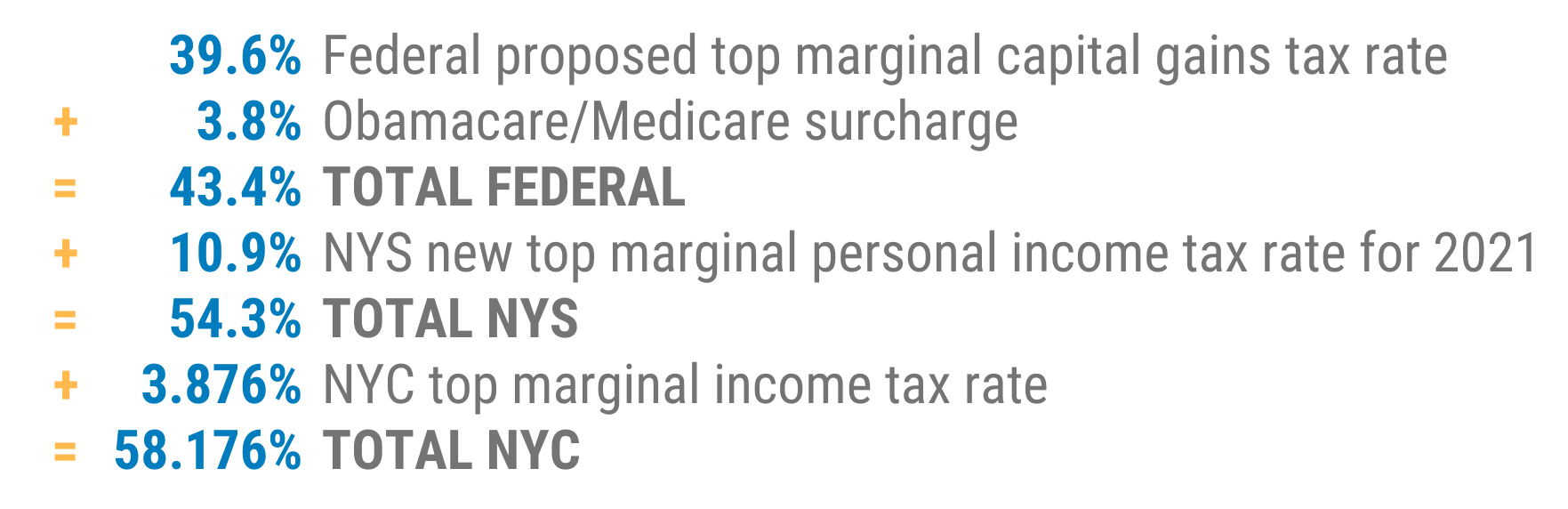

For taxpayers with income over 1 million Biden has proposed raising the top capital. Interest rates at 3 for 30-year fixed loans. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

So that makes the total 238 which is still vastly better than 37 or 396. Home Resource Center Proposed Changes to Taxation of Capital Gains. Home prices were skyrocketing earlier this year.

With this new plan that rate will increase to a whopping 396--nearly. Subscribe to receive email or SMStext notifications about the Capital Gains tax. The residential housing market in the US.

The Presidents tax plan would raise the top ordinary tax rate from 37 to 396. Raising The Top Tax Rate. The top capital gains rate would nearly double to 396 from 20 currently and the additional 38 Medicare surtax that currently applies would bring the highest capital gains tax.

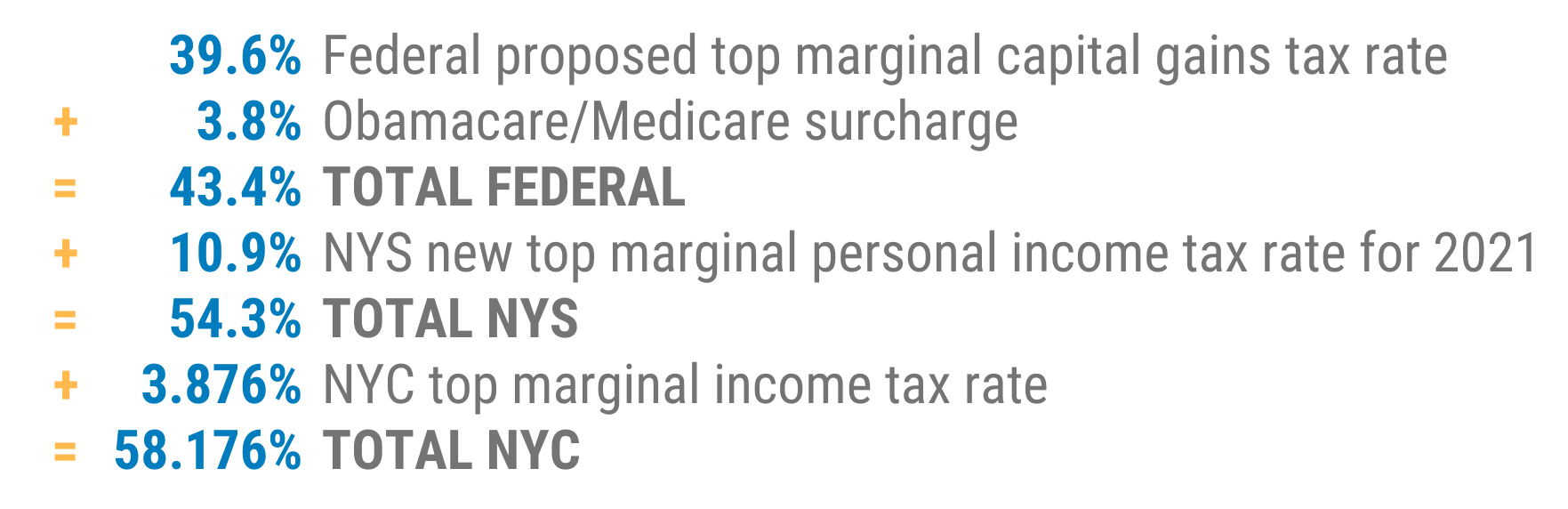

Currently the highest capital gain rate is 20 but you must add the 38 Obamacare tax. When you include the 38 net investment income tax NIIT that rate jumps to 434. President Donald Trumps main proposed change to the capital gains tax was to repeal the 38 Medicare surtax that took effect in 2013.

Bidens tax increases say Americas richest citizens can afford to pay more. House Democrats capital gains tax proposal is better for the super rich than Biden plan House Democrats proposed a top 25 federal tax rate on capital gains and dividends. Proponents of Mr.

President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. While 100000 is real money it will be paid by a group of people who earn an. Has changed radically in a few months.

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Senate Republicans Urge Biden Not To Move Forward On Capital Gains Tax Proposal Financial Regulation News

What Are Capital Gains Taxes And How Could They Be Reformed

Capital Gains Full Report Tax Policy Center

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Opinion Biden Proposes A Big Change To Capital Gains Taxes This Is How They Work And Are Calculated Marketwatch

Capital Gains Economic Impacts Of The Biden Administration S Proposed Changes To The Taxation Of Long Term Capital Gains Center For Capital Markets Competitiveness

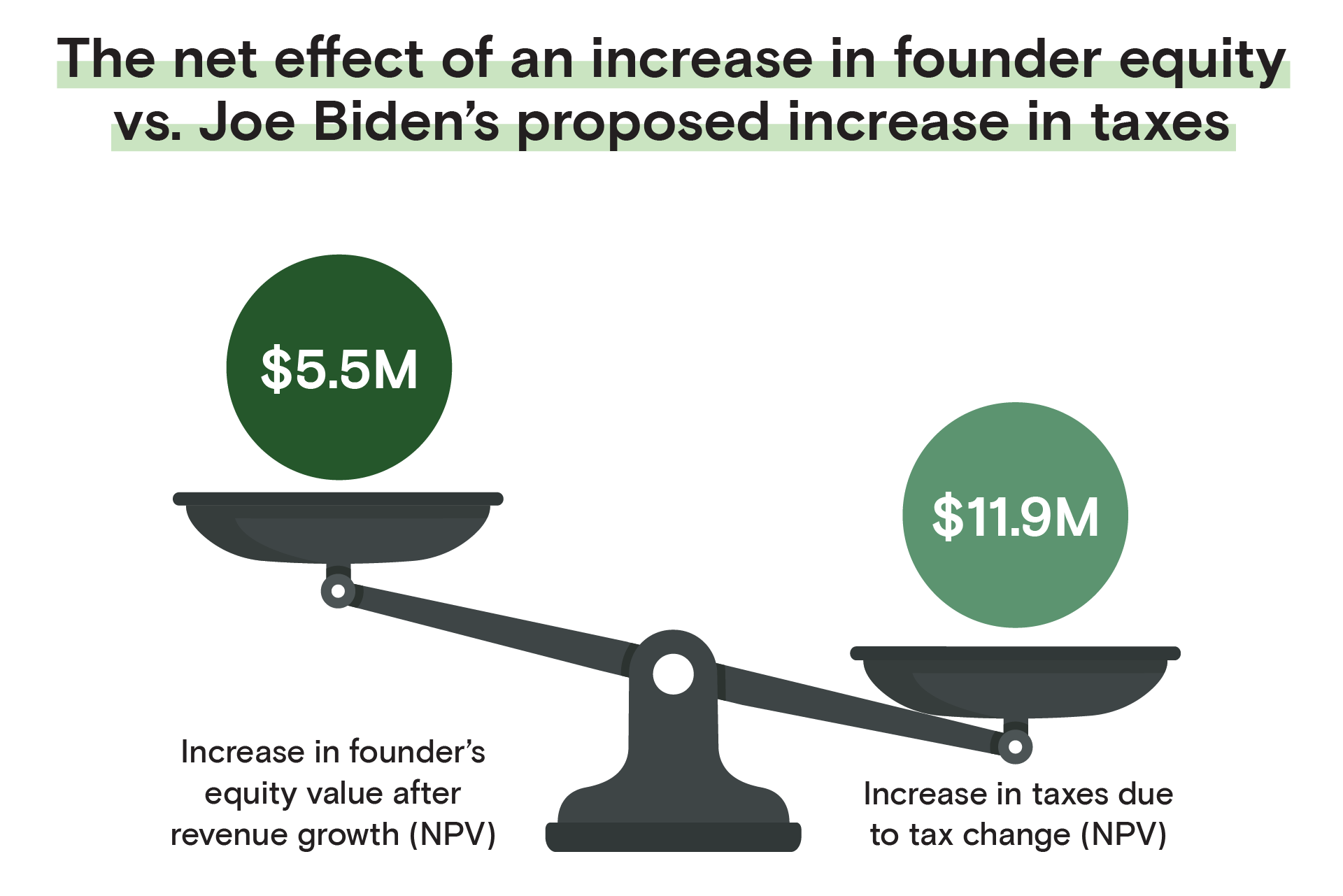

For Founders The Implications Of Joe Biden S Proposed Tax Code

Opinion Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Marketwatch

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

Do The Math Cap Gains Tax Hike For New Yorkers Dsj Cpa

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget