are hoa fees tax deductible in california

When it comes to state taxes the laws differ from state to state. However there are special cases as you now know.

Toluca Lake Homeowners Association Los Angeles Ca

You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner.

. You cannot claim a deduction for the HOA fee when it is your primary. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

Your HOA may need to file a state homeowners association tax return depending on the location you are in. As a general rule no fees are not tax-deductible. In other words hoa fees are deductible as a rental expense.

There are many costs with homeownership that are tax-deductible such as your mortgage interest. Are HOA fees paid on a rental property tax deductible. But the profit is taxed at the 30 rate as compared to the corporate tax that starts at 15.

Primarily HOA fees are not tax-deductible when you as the homeowner reside in it 100 of the time. Estimated tax payments may be required. In general HOA fees are not tax deductible in California.

So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. Tax-exempt organizations and unincorporated Homeowners association are not subject to the minimum franchise tax. HOA fees on personal residence - not deductible.

The due date is. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. Deduct as a common business expense for your rental.

May 31 2019 948 PM. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600. The answers not as straightforward as you might think.

The IRS considers HOA fees as a rental expense which means you can write them off from your. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities. Say Thanks by clicking the thumb icon.

Filing your taxes can be financially stressful. Year-round residency in your property means HOA fees are not deductible. The IRS views them as personal expenses not a tax rendering them ineligible as tax deductible.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. As a homeowner it is part of your. The IRS considers HOA fees as a rental expense which means you can write them off from your.

Are Hoa Fees Tax Deductible Here S What You Need To Know

Do All Condos Have Hoa Fees Quora

The Definitive List Of 35 Home Business Tax Deductions

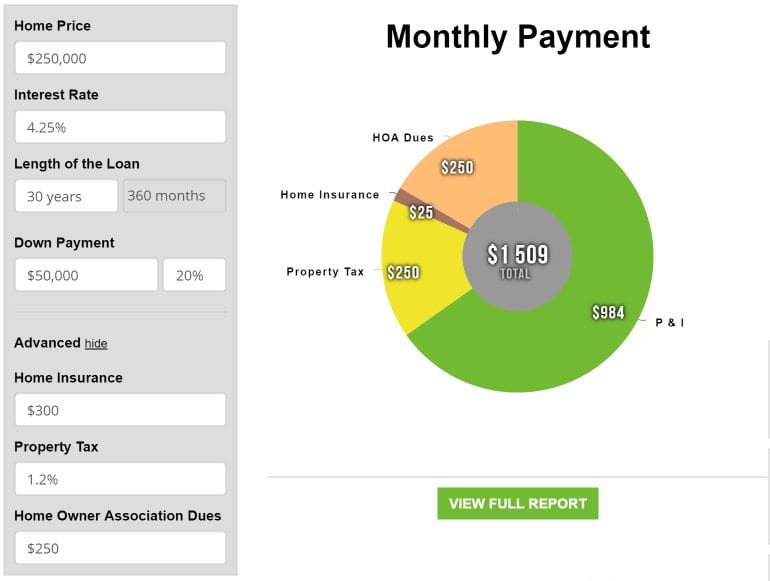

Hoa Dues Can Make A Condo More Spendy Than A House Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Assessments Category Archives Hoa Lawyer Blog Published By California Hoa Attorneys Tinnelly Law Group

How To Understand California Hoa Rules Big Block Realty

Property Tax Deduction Explained Quicken Loans

Are Hoa Fees Tax Deductible Here S What You Need To Know

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Hoa Fees Tax Deductible In California Hvac Buzz

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Are Hoa Fees Tax Deductible In California Hvac Buzz

Closing Costs For Buyers In California Houzeo Blog

Are Hoa Fees Tax Deductible Experian

Tax Deductions For Homeowners Nerdwallet

Hoa Fees What You Should Know Before You Buy Forbes Advisor

Are Hoa Fees Tax Deductible Here S What You Need To Know

Hoa Fees Things To Keep In Mind When Searching Va Approved Condos

California Hoa Condo Tax Returns Tips To Stay Compliant Template